Need an insurance plan to keep you covered? Find a trusted, BBB Accredited insurance agency near you at BBB.org.

Insurance industry

Given the nature of their business, the insurance industry is always “top of mind” in times of economic distress or natural disasters, making the last few years rather eventful for all parties involved. With the pandemic-fueled slowdown coming to an end, the insurance industry is well-positioned to see growth through 2026 despite a slowing economy on the horizon. This growth does not come without industry-wide challenges, as insurance companies are still working to adapt and implement new technologies and retain top staff given rising wage demands.

Introduction

As modern life continues to improve with new technologies and products, so has the demand for new types of insurance and related financial services. Today, it’s almost impossible to get through one’s day without experiencing the benefits, protections, and peace of mind that insurance provides. Initially, insurance policies were entirely optional for individuals or businesses. However, over the last 250 years, some forms of insurance became a legal prerequisite for specific purchases or activities, while other insurance policies and products remained optional.

As a result of consumer demands, state regulations, and federal oversight, the “insurance industry” can be subdivided into three distinct subcategories:

- Agents and brokers provide property and casualty (P and C) insurance for our businesses, homes, and autos and provide some specialized programs.

- Life and Annuities typically provide life insurance and retirement/annuities such as 401Ks, SEP plans, IRAs, Roth IRAs, and IRAs for education savings (529 plans).

- Health and Medical provide public/private insurance plans that provide dental, medical, and mental health services.

While the underlying premise of insurance is loss replacement or paying service providers, each company determines its underwriting process and fee structure independent of the competition. Therefore, rates and coverages can vary dramatically from one insurance company to another.

The insurance industry in 2022

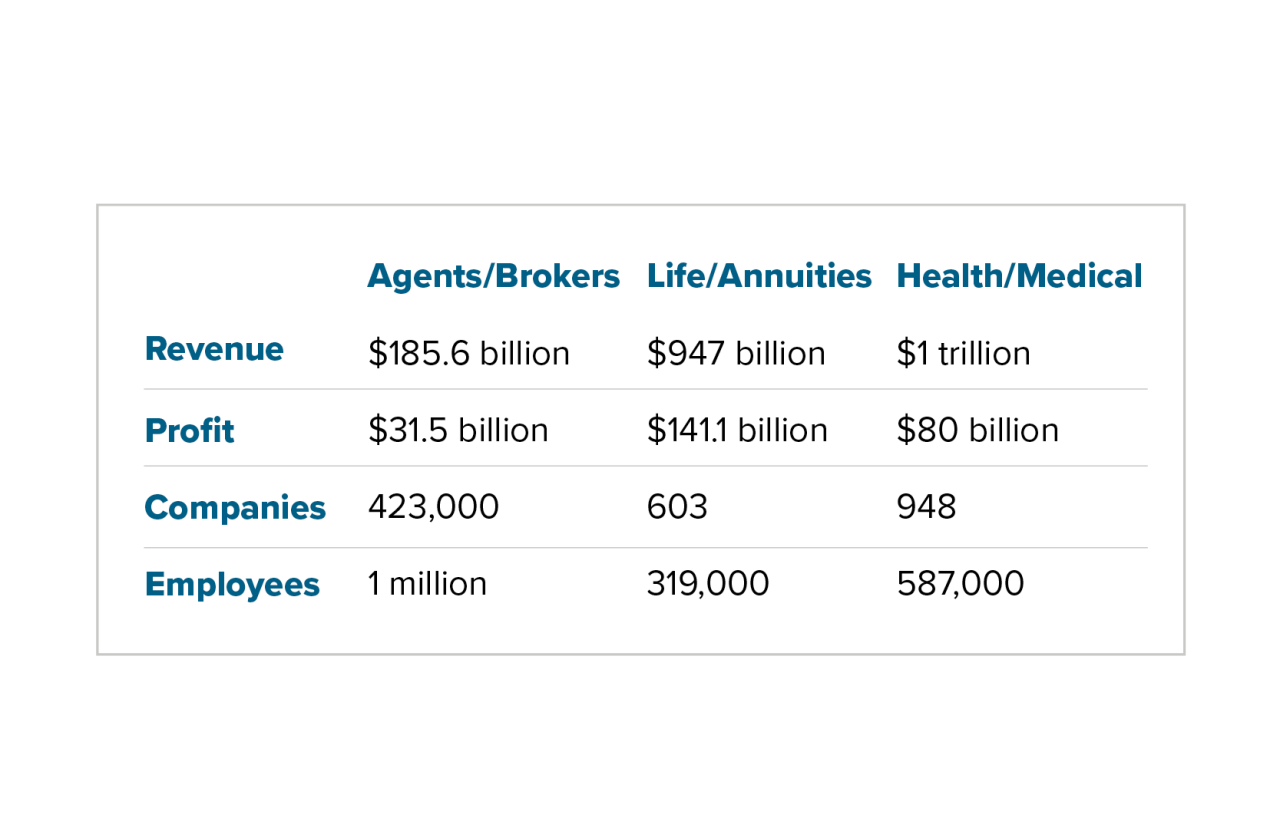

In 2021, the “insurance industry” generated a staggering $2,132,000,000,000.00 (two trillion, one hundred thirty-two billion dollars) in total revenue across all products and services provided to consumers and companies. To make the data easier to digest, in this white paper, we will separate the three subcategories that make up the insurance industry in the US today.2

What’s obvious is that the insurance sub-industry with the lowest revenue and profit margin also has the most companies and employs the most workers. But those types of insurance products (property and casualty insurance) experience more claims as our cars and homes are a cornerstone of our daily lives. In addition, P and C claims are more complex. They require more interactions with agents, underwriters, estimators, and a network of service contractors to provide repairs to a damaged vehicle or home.

We can also see the highest profit potential in the sector with the fewest employees, life insurance and annuities. In addition, after the initial underwriting process, most life insurance policies require minimal contact and maintenance over the policy’s life compared to P and C claims.

The health and medical insurance industry also requires underwriting and premium collections. Still, most of their work involves establishing service levels such as gold, silver, bronze and negotiating and maintaining service costs across their service provider network and out-of-network partners.

The annualized growth for agents and brokers should remain constant as most states now require insurance for homes and vehicles purchased using a loan or other financing options.

Life and annuities revenue declined slightly during the pandemic as many consumers suspended or delayed payments to retirement plans and policies during the economic downturn.

Part of the growth shown for the health/medical category was due to the mandatory requirement of the Affordable Care Act (ACA). However, the Tax Cut and Jobs Act of 2017 eliminated that requirement in 2019. And during the pandemic, many employees lost not only their jobs but their health insurance, too, which should have led to a sharp revenue decline. But the CARES Act of 2020 made changes that qualified millions for Medicare and other government insurance programs.

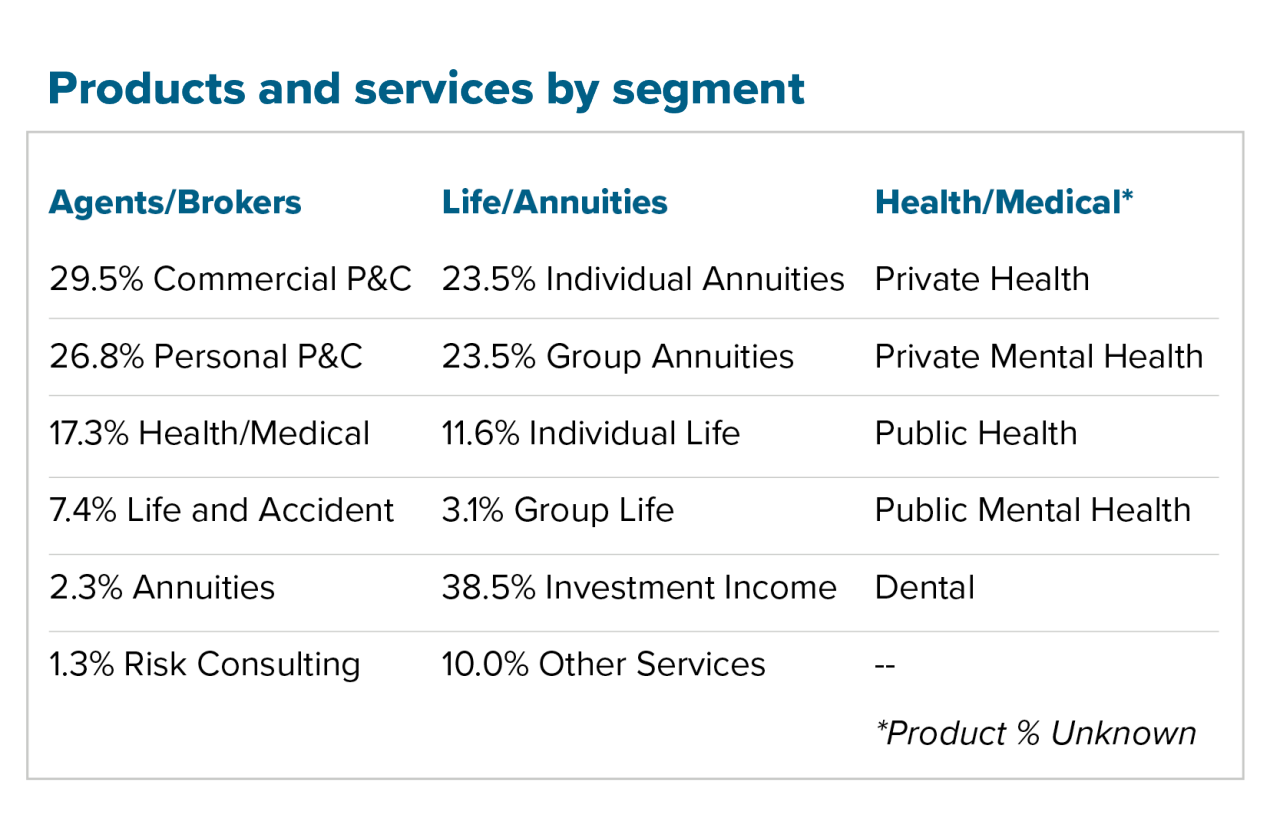

As the chart shows, the insurance industry has distinct segments as the Life and Annuities, and Health and Medical insurance industries do not overlap when comparing services and products.

And while the bread and butter for most Agents and Brokers are P and C policies for homes, businesses, and vehicles, some agents have expanded their services due to consumer demand or increasing industry consolidation.

Life/annuities products and services have always been optional, and the lack of a significant player should come as no surprise. Of the four most prominent providers, no company has yet attained a double-digit market share.

P and C insurance has been mandatory for autos since 1925 (Connecticut and Massachusetts)3. Homeowners’ insurance is not a requirement in any state, but lenders can require purchasers to obtain a policy. The agents/brokers market remains wide open despite these requirements since the three largest companies maintain a combined market share of less than 13%.

Four health insurance providers established a robust combined market share of nearly 70% of the $1 trillion generated in 2021. Health insurance was only a requirement from 2012 to 19, and since then has become the most sought-after employee benefit requested by job seekers.

Industry trends

Based on IBIS data2, the most pressing issues for the insurance industry are as follows:

- Increased competition from online brokerages can lower profit margins, prolonging the hard market status.

- Increased housing demand, fueled by higher wages and disposable income, has increased premiums for home and auto products.

- Catastrophe insurance demand to rise due to the increased frequency of natural disasters.

The insurance industry has gained first responder status for minimizing financial risk in times of crisis by supplying immediate financial relief to individuals, businesses, and governments. Many experts expect the pandemic to become the largest loss event in insurance history.

Because people and companies from all levels, backgrounds, and industries have suffered through economic hits over the last two years, insurance demand will continue to climb through 2026, as risk awareness continues to grow.

Beyond 2022

As the effects of the pandemic continue to fade, the insurance industry remains poised to take advantage of some of the immediate growth potential resulting from higher wages, and continued demand for new homes and vehicles.

There is also a small window of opportunity for the industry, however, as the overall economic situation worldwide does not look “growth friendly,” with economists predicting tough years ahead regardless of industry.

This near term growth potential will also be challenging as implementing new technologies and preparing for future catastrophic claims while maintaining existing staffing levels, especially those requiring advanced experience or skill sets, is no simple task.

Those who are able to take advantage of the opportunities available today, while also taking the necessary steps to protect themselves in an economic downturn will be the ones who ultimately come out on top.

1. Economic outlook

According to IBIS research, the insurance industry can expect an annual growth rate of 2.7% through 2026 and an increase in profit margins ranging from 1.5-3.1% depending on the sector.

As a result of the pandemic, the entire consumer purchasing cycle has changed dramatically. According to a recent Deloitte survey4, “Insurers are increasingly dependent on emerging technologies and data sources to drive efficiency, enhance cybersecurity, and expand capabilities across the organization. However, most should also focus on improving the customer experience by both streamlining processes with automation, as well as providing customized service where needed and preferred.”

Customer-centric platforms that allow customers to shop/compare, make payments, request policy changes, and file a claim in real-time are no longer optional for insurance companies looking to grow their market share.

2. Inflation is on everyone’s mind

Inflation doesn’t discriminate; it has the potential to wreak havoc on everyone’s budget, including insurance companies. Replacement costs always include an inflation factor, but the pandemic supply chain shortages created forced prices well beyond anticipated price increases. For example, the future price for lumber in March 2020 was $303.40 per thousand board feet. That price quintupled over the next fourteen months to $1,607.50 in May 2021 for the same lumber.5

Inflation should remain a concern for the foreseeable future, as it has the potential to hinder growth and reduce profit margins for insurance companies. However, unlike the hard market created by low-interest rates over the last few years, soft market conditions will reappear as the inflation rate slows and eventually drops.

3. Future of work is here

Fueled by the stay-at-home orders and the “Great Resignation,” insurance companies are working to support the future workplace, whatever that may be. While remote and Work From Home (WFH) options became popular during the pandemic, insurance companies are working to support in-office, WFH, and hybrid (mixed) work environments for the industry moving forward.

This mindset is a stark shift from the traditional insurance company office, where everyone worked from a central or branch location. While many expected employee attendance and productivity to drop dramatically for WFH workers, the data suggests otherwise. According to Apollo Technical6, several recent studies indicate that those who WFH spend less time unproductively, typically work one extra day per week, and are 47% more productive.

Even with these perks in place, many insurance companies struggle with recruitment and employee retention. Senior staff and leadership roles are especially problematic, thanks again to the “Great Resignation” and competing companies’ higher wages.

4. Find and keeping talent remains a challenge

Currently, the national unemployment rate7 is at 3.6%, down from its peak of 14.7% two years ago. As a result, insurance companies find themselves fishing from the same shrinking potential-employee pond as everyone else.

Insurance companies are still struggling to hire and retain talent for more technical roles such as data privacy protection, cybersecurity/risk management, and distribution management roles and services despite advances in technology and workplace flexibility.

This talent shortage is particularly evident for roles requiring advanced skill sets, such as climate risk impact assessment. “A disaster-related to a weather, climate or water hazard occurred every day on average over the past 50 years – killing 115 people and causing US $202 million in losses daily,” according to a detailed new report from the World Meteorological Organization (WMO)8. Over this period, the number of disasters increased by a factor of five, but thanks to improved early warnings and disaster response, the number of deaths decreased almost three-fold.

5. Technology is great, but relationships matter

Insurance companies have embraced technology to streamline their operations to become more efficient, but this hasn’t made the client experience better. Deloitte’s report2 suggested that “most should also focus on improving the customer experience by both streamlining processes with automation and providing customized service where needed and preferred.”

The report also suggests that many carriers should take steps to bolster trust among stakeholders by being more transparent in how they collect and use personal data. As well as being more proactive in seeking comprehensive solutions to big picture societal problems such as mitigating the financial impact of future pandemics and natural catastrophes.”

With many insurance companies rushing to implement technology to better the customer experience, the human touch could become the growing differentiator if inflation leads to a significant economic slowdown.

Sources:

(1) Timeline https://www.investopedia.com/articles/financial-theory/08/american-insurance.asp

(2) IBISWorld US INDUSTRY (NAICS) REPORT 52421 / FINANCE AND INSURANCE Insurance Brokers & Agencies in the US Report by: Gabriel Schulman 2021

(3) https://www.everquote.com/blog/questions/when-did-car-insurance-become-mandatory/

(6) https://www.apollotechnical.com/working-from-home-productivity-statistics/